High-Pressure Hydrogen Compressors Market Size to Reach USD 894.98 Billion by 2032

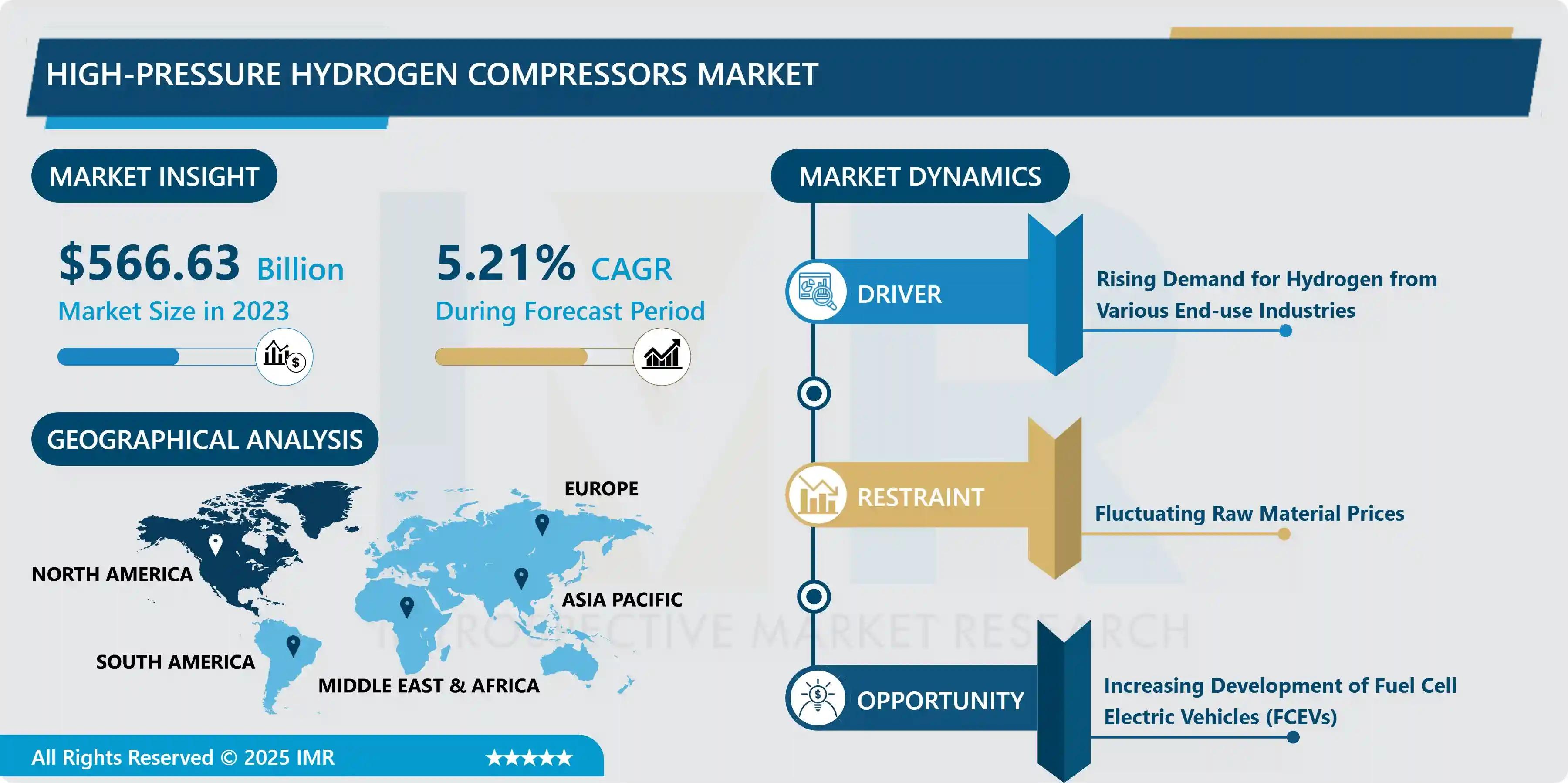

According to a new report published by Introspective Market Research, High-Pressure Hydrogen Compressors Market by Compressor Type, Application, and End-User, The Global High-Pressure Hydrogen Compressors Market Size Was Valued at USD 566.63 Billion in 2023 and is Projected to Reach USD 894.98 Billion by 2032, Growing at a CAGR of 5.21%.

Market Overview:

The global High-Pressure Hydrogen Compressors market is a critical enabler of the emerging hydrogen economy, providing the essential technology to compress hydrogen gas to the high pressures required for efficient storage, transportation, and dispensing. These specialized compressors overcome the challenges of hydrogen's low density, enabling its use in applications like fuel cell vehicle refueling, industrial processes, and energy storage. Compared to traditional compressors, they offer superior safety features to handle hydrogen embrittlement, higher energy efficiency to reduce operational costs, and reliability for continuous operation in demanding environments.

These compressors are foundational to major industries driving the clean energy transition. Their primary use is in hydrogen refueling stations for fuel cell electric vehicles (FCEVs) within the transportation sector. They are equally vital in industrial applications such as chemical production (e.g., ammonia synthesis), petroleum refining, and metallurgy. Furthermore, they play a key role in energy storage systems, where hydrogen is compressed for later use in power generation. As nations worldwide commit to decarbonization goals, the demand for reliable and efficient high-pressure hydrogen compression is experiencing unprecedented growth, positioning this market at the heart of sustainable infrastructure development.

Growth Driver:

The paramount growth driver for the High-Pressure Hydrogen Compressors market is the accelerating global policy and financial commitment to establishing a green hydrogen economy as a cornerstone of decarbonization. Governments worldwide are implementing ambitious national hydrogen strategies, injecting billions in subsidies for infrastructure, including production, storage, and refueling stations. This policy-driven momentum is directly translating into large-scale investments in hydrogen projects, creating an immediate and sustained demand for the core compression equipment needed to make hydrogen transportable and usable at scale, from production sites to end-point applications like heavy transport and industry.

Market Opportunity:

A significant market opportunity lies in the technological advancement and commercialization of next-generation compressors that offer dramatically higher efficiency, lower maintenance, and greater scalability. Innovations such as oil-free ionic liquid piston compressors and electrically driven diaphragm models reduce contamination risks and operational costs, making them ideal for large-scale renewable energy storage and gigawatt-scale green hydrogen projects. Companies that develop modular, scalable compressor solutions tailored for decentralized hydrogen production (like at wind or solar farms) and those that integrate smart IoT for predictive maintenance will capture a premium market segment as the industry moves from pilot projects to mass deployment.

High-Pressure Hydrogen Compressors Market, Segmentation

The High-Pressure Hydrogen Compressors Market is segmented on the basis of Compressor Type, Application, and End-User.

Compressor Type

The Compressor Type segment is further classified into Diaphragm, Ionic Liquid, Piston, and Others. Among these, the Diaphragm sub-segment accounted for the highest market share in 2023. Diaphragm compressors dominate due to their inherent safety and purity advantages in handling hydrogen. Their design ensures zero leakage of the gas and prevents contamination by completely separating the compression chamber from the hydraulic oil and mechanical parts. This makes them the preferred choice for sensitive applications like fuel cell vehicle refueling and high-purity hydrogen processes in the electronics and chemical industries, ensuring reliable and clean compression.

Application

The Application segment is further classified into Refueling Stations, Storage, Transportation, and Industrial Processes. Among these, the Refueling Stations sub-segment accounted for the highest market share in 2023. This dominance is directly linked to the global rollout of hydrogen refueling infrastructure to support fuel cell electric vehicles (FCEVs), particularly for buses, trucks, and passenger cars. Each refueling station requires one or more high-pressure compressors to dispense hydrogen at 700 bar, making this application the most immediate and volume-intensive driver of compressor demand as nations build out their H2 mobility networks.

Some of The Leading/Active Market Players Are-

• Howden Group Ltd. (United Kingdom)

• Linde plc (Ireland)

• Siemens Energy AG (Germany)

• Ariel Corporation (United States)

• Burckhardt Compression Holding AG (Switzerland)

• PDC Machines, Inc. (United States)

• Atlas Copco AB (Sweden)

• Baker Hughes Company (United States)

• Hitachi, Ltd. (Japan)

• INOXCVA (India)

• HAUG Sauer Kompressoren AG (Switzerland)

• Hydro-Pac, Inc. (United States)

• and other active players.

Key Industry Developments

News 1:

In March 2024, a leading compressor manufacturer launched a new, fully integrated 700-bar ionic liquid compressor module, designed to reduce the footprint and installation time for hydrogen refueling stations by over 40%.

News 2:

In February 2024, a major energy consortium secured funding for a gigawatt-scale green hydrogen project in Europe, specifying the use of advanced high-pressure diaphragm compressors for storage injection, signaling confidence in the technology for large-scale deployment.

Key Findings of the Study

• Diaphragm Compressors lead the product type segment, prized for safety and purity.

• The Refueling Stations application is the largest and fastest-growing segment.

• Market growth is primarily fueled by global green hydrogen initiatives and decarbonization policies.

• Europe and Asia-Pacific are the leading regional markets, driven by strong governmental support.

• Key trends include the development of oil-free technologies and integration with renewable energy systems for green hydrogen production.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness