Satellite Propulsion System Market Forecast: Electric, Chemical & Hybrid Propulsion Driving Next-Gen Satellite Deployments

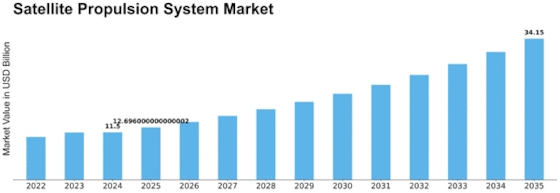

As the Satellite Propulsion System Market charts its growth path toward USD 34.15 billion by 2035 (per MRFR forecast), multiple future-facing factors — both opportunities and challenges — will shape which players succeed.

One key opportunity lies in hybrid and green propulsion systems. As launch costs and sustainability concerns rise, satellite programmes — both commercial and governmental — are increasingly looking for propulsion systems that reduce propellant mass, lower launch weight and minimise environmental impact. This mirrors broader trends in the “Space Propulsion Systems Market,” where innovations in propulsion are shifting toward electric, green-propellant and reusable solutions.

Another promising area is miniaturization and small-satellite constellations. With projections suggesting thousands of small satellites could be launched over the next decade, demand for compact, efficient micro-thrusters and electric/chemical hybrid propulsion will surge. Suppliers who invest in micro-propulsion, modular designs, and cost-effective manufacturing will likely capture significant share.

However, with opportunity comes challenges. First, development and certification of advanced propulsion systems — especially electric, hall-effect, iodine, or hybrid fuel systems — can be technically complex, expensive, and time-consuming. For new entrants or smaller companies, R&D investment and regulatory/space-agency certification could be barriers.

Second, the diversity of propulsion types and satellite requirements means that “one-size-fits-all” solutions are unlikely to suffice. Satellite designers vary widely in platform size (CubeSat, microsat, midsize, GEO, LEO), mission profile (communications, earth observation, navigation, scientific), and orbit requirements. Propulsion providers will need to offer a portfolio of propulsion solutions — chemical, electric, green, cold-gas, micro-thruster — to serve this heterogeneity.

Third, supply-chain robustness and global competition may challenge firms. As demand expands globally — especially into emerging regions — maintaining quality, delivery, and after-sales support across regions (North America, Europe, Asia-Pacific) will be critical. Firms must balance innovation with reliability and operational maturity.

Looking ahead, strategic alliances, partnerships, and R&D collaborations may define the winners. Just as in the broader aircraft propulsion system market and space propulsion sectors, the trend is toward cooperation between OEMs, propulsion-system specialists, satellite manufacturers, and agencies. Firms that position themselves as integrated suppliers — combining propulsion hardware, power systems, mission-planning tools and after-market support — may enjoy competitive advantage.

In conclusion, the Satellite Propulsion System Market stands at an inflection point. With strong projected growth, evolving technologies, expanding demand from small-sat constellations and rising interest in sustainable/efficient space operations, the next decade could redefine what satellite propulsion means. But success will depend on innovation, flexibility, strategic foresight, and the ability to navigate technical and market challenges. For stakeholders — manufacturers, investors, satellite operators — the time to plan, invest and adapt is now.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness