-

Новости

- ИССЛЕДОВАТЬ

-

Страницы

-

Группы

-

Мероприятия

-

Статьи пользователей

-

Offers

-

Jobs

-

Форумы

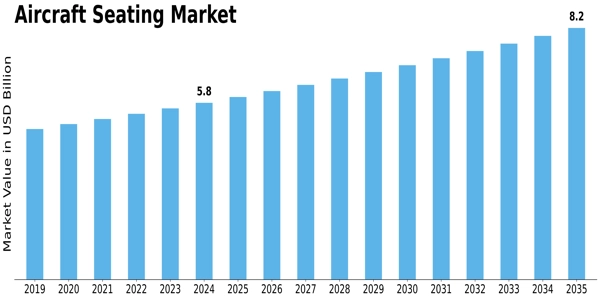

Global Aircraft Seating Market Industry Analysis and Future Outlook

As the aviation world accelerates toward a new normal of travel, the aircraft seating market is poised to benefit from both volume growth and design evolution. Valued at about USD 5.57 billion in 2023, the market is projected to reach approximately USD 8.2 billion by 2035, with a CAGR of around 3.26% from 2025 to 2035.

Industry Overview

Aircraft seating is a key element of cabin design, intersecting with airline branding, passenger comfort, aircraft performance and regulatory compliance. Seat manufacturers must address a complex mix: weight-savings (for fuel efficiency), material durability, ergonomic comfort, modular flexibility for cabin reconfiguration, and certification for safety and fire/smoke standards. Airlines utilise seating as part of their product offering, and retrofit programmes for ageing fleets add to demand beyond just new aircraft orders.

Market Outlook

Over the next decade, the market’s moderate growth is underpinned by several strong themes: expanding air travel globally, increasing fleet sizes (especially narrow-body jets), the rising appeal of premium economy seats, retrofit and re-configuration of existing aircraft, and the push for sustainability (lighter materials, less fuel burn). Although the sector is mature—meaning growth is incremental rather than exponential—the innovation potential is significant for those who prioritise lighter structures, intelligent features (connectivity, ergonomics) and efficient manufacturing.

Key Players’ Role

Several companies are steering the market forward. Sichuan Tengdun stands out for its broad offering (economy through first-class seats) and global reach. Universal Aviation Seating focuses on high-end, custom solutions for commercial and private aviation. Recaro Aircraft Seating, Zodiac Aerospace and Thompson Aero Seating contribute with scale, innovation investment and deep industry relationships. These firms are central to transitioning the market toward modular, lightweight and smart seating systems that meet modern airline expectations.

Segmentation Growth

Growth patterns by segmentation are clear:

- Seat Type: Economy class continues to dominate by volume; it is forecast to grow from roughly USD 2.88 billion in 2024 to about USD 4.05 billion in 2035. Premium economy seats are gaining visibility as airlines adjust cabin configurations.

- Material: Categories include leather, fabric, plastic and metal. Innovations are focusing on plastics and lightweight metals/composites to reduce weight while maintaining comfort and structure.

- Aircraft Type / End-User: Narrow-body aircraft dominate market demand; wide-body and regional segments remain important as well. The main end-user remains commercial airlines; private and military aviation add differentiated demand streams.

- Region: North America leads in value (about USD 2.25 billion in 2024) followed by Europe and Asia-Pacific. Regions like South America and the Middle East & Africa are growing and represent future expansion corridors.

Closing Remarks

For those tracking aerospace interiors, the aircraft seating market offers an interesting vantage point—where comfort, materials science, airline economics and sustainability converge. While the growth rate is modest, the strategic shifts are meaningful. Manufacturers and airlines who invest in light-weight materials, modular architectures and passenger-centric design will be well-positioned to succeed as cabin environments continue to evolve.

Discover More Research Reports on Aerospace & Defense By Market Research Future:

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness